An option gives the buyer the option to buy or sell on the type of contract that they hold on a specified future day. Options are a type of trading instrument that are derivatives based on the value of underlying stocks or other financial assets. You can do the calculation by yourself manually or you can just plugin the number to our options profit calculator to get the results quickly. On the other hand, if the stock falls to $60 or under, then you just lose your initial investment of $500 for buying the option contracts. Therefore, you made $4,500 on this options investment. Profit Formula = Current stock value - Strike price value - Total Investment Here's how you calculate your options profit.Ĭurrent stock value = 500 x $70 = $35,000 Outro/FAQ - My farewell with some questions I get asked frequentlyĢ6 Videos, Ready to stream immediately after purchase.Assume the strike price for the options is $60, and the stock has risen to $70 since you bought the options. Range Trading - understanding how a range trading strategy worksĪveraging Down - understanding how averaging down worksĬontract Multiplier - understanding how the contract multiplier strategy works OTM long term -understanding how a long term OTM (Out The Money) strategy works

OTM short term - understanding how a short term OTM (Out The Money) strategy works RSI- understanding Relative Strenth Index and what it tells youīasic CandleStick Patterns - Pattern you can use to support the entry/exit for the strategies you choose to use.ĪTM/ITM - understanding how ATM/ITM (In/At The Money) strategy works Moving Averages & MACD - understanding Moving Averages Convergence Divergence (MACD) with demo Support & Resistance- understand support and resistance with examples U.C.E: Understand, Capitalize, Execute - What to do with your research and analysis once you are ready to trade Technical Analysis(All have live demos):

OPTIONS PROFIT CALCULATOR ROBINHOOD HOW TO

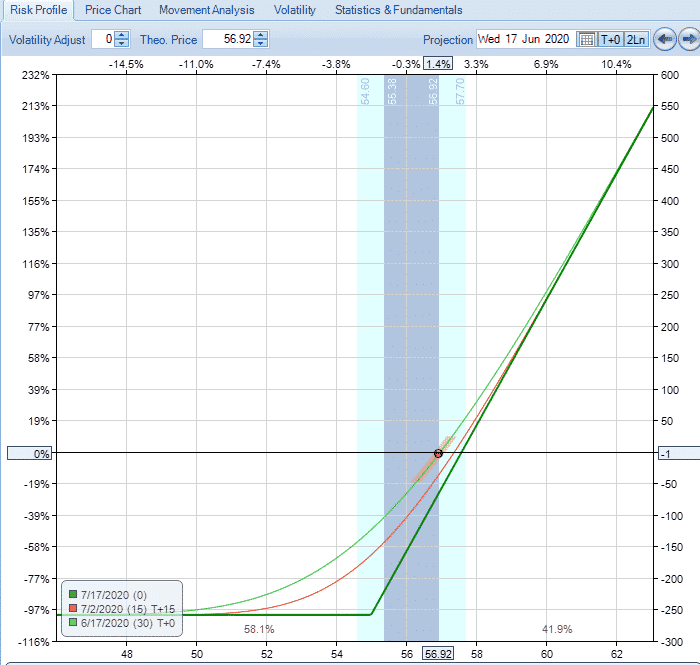

S.earch - How to build a watchlist and do research when you have no idea what stocks to tradeĪ.nalyze Pt 1/2 - How to analyze the data/information you've found on your stock Intro - An explanation of what the "Sauce" means You have already learned the -What- when it comes to Options Trading, and understand the concepts of what it means but you need help with the -How. You don't really understand technical analysis You have no idea when you should exit a trade (sell it for profit) You do not have an established profit point/percentage You have a vague idea or NO IDEA AT ALL what your strategy is or should be. You've made a few trades and made money on some, lost money on some, but just can't seem to get wins consistently. Using The Options Profit Calculator: How to use a powerful tool in helping you understand your potential profit on your options trades

Navigating Robinhood: How to get around the app, search stocks, view your account info.Course Introduction / Options Basics: An Introduction To Options Trading.A strong foundation + tools and strategy are the keys you need to make money trading options. (With live video Examples of past trades) This is your ticket to print money. You'll learn how to do technical analysis, how to do research, and show you some trading strategies you can use to make money. This course will teach you the basics of how to trade Stock Options, AND it will teach you strategies you can use to make money consistently trading Options.

0 kommentar(er)

0 kommentar(er)